In the realm of financial planning, the decision to secure critical illness coverage can be a pivotal one, as demonstrated by the inspiring story of our clients. To maintain their privacy, we will refer to them as Mr and Mrs Johnson. Initially hesitant about obtaining critical illness coverage, their lives took an unexpected turn, underscoring the profound impact of such policies. This article highlights their journey that has seen them receive a £133k critical illness payout.

The Beginning: Hesitation Turned to Gratitude

When the Johnsons first approached us, the idea of critical illness coverage felt like an unnecessary expense. Like many, they questioned the need for such insurance, thinking they were invulnerable to health crises. However, as fate would have it, their perspective shifted dramatically.

Critical illness does not discriminate based on age, lifestyle, or financial stability. The Johnsons’ story is a testament to the unforeseeable nature of life’s challenges. What began as reluctance transformed into immense gratitude for the protective shield their critical illness policy provided.

The Unexpected Turn: A £133k Critical Illness Payout

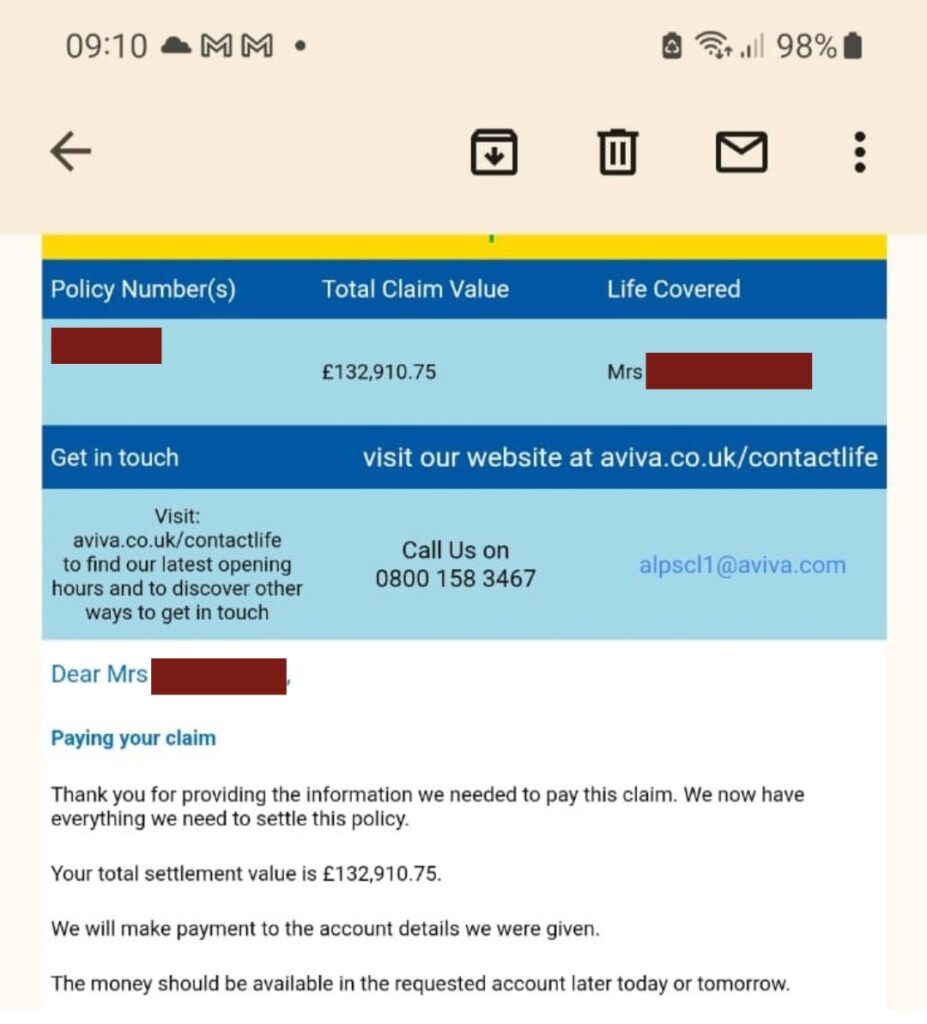

Tragically, Mrs. Johnson was diagnosed with cancer, a diagnosis that no one anticipates or welcomes. However, the financial burden that often accompanies such situations was significantly eased by the critical illness policy they had secured. They received a substantial payout of £132,910. This provided not just financial relief but also peace of mind during a challenging period. Thanks to Aivia for making this payout process smooth and stress-free.

How the Payout Can Be Utilised: More Than Medical Bills

The beauty of critical illness coverage lies not just in its financial support during medical crises but also in the flexibility it offers. The Johnsons, like many policyholders, are using the payout to pay off their mortgage, a decision that brings both emotional and financial security. Critical illness coverage can be used for various purposes, including but not limited to:

- Mortgage Payment: Clearing or reducing mortgage debt to secure the family home is a common and wise choice.

- Rent Payments: If you are a tenant, the payout can provide relief by covering rent payments during a period of illness.

- Bills and Daily Expenses: From utility bills to everyday expenses, the payout helps maintain a sense of normalcy when income is disrupted.

- Medical Expenses: While the NHS provides excellent care, there may be additional medical expenses. The payout can cover treatments, medications, or therapies not covered by public health services.

Critical Illness Coverage: Not a Luxury

The Johnsons’ story is a compelling reminder that critical illness can strike anyone, at any time. Encouragingly, their decision to obtain critical illness coverage has not only shielded them from financial strain but has also empowered them to make choices that positively impact their future.

We urge our readers to consider the unpredictable nature of life and the potential financial ramifications of a critical illness. Obtaining critical illness coverage is not merely a precaution; it’s a proactive step towards securing your financial well-being in the face of unforeseen health challenges.

Your Financial Shield in Uncertain Times

The Johnsons’ journey from hesitancy to gratitude is a poignant example of the invaluable protection critical illness coverage can provide. It goes beyond being a financial safety net; it becomes a lifeline during challenging times. Whether it’s paying off a mortgage, covering bills, or addressing medical expenses, the flexibility of the payout is a powerful tool in securing your financial future.

As financial advisors, we advocate for preparedness and proactive decision-making. The Johnsons’ experience reinforces the importance of critical illness coverage as a cornerstone in your financial plan. Don’t wait for life’s uncertainties to dictate your financial well-being—take control, secure your future, and consider critical illness coverage as a vital component of your financial shield.

Contact us today, let’s get you started on your journey to a secure future.

Note – The information contained within was correct at the time of publication but is subject to change.